Commission-based income professionals face cash flow challenges, making title loans an attractive option for quick funding secured against vehicle value. However, integrating these short-term loans with variable commission structures requires clear loan terms and flexible options like payoff extensions to ensure sustainable borrowing experiences.

In today’s financial landscape, commission-based earners often face unique challenges when seeking immediate funding. Title loans, offering quick access to cash secured by a vehicle title, have emerged as an option. However, integrating these short-term solutions with the variable nature of commission income presents distinct obstacles. This article delves into understanding commission-based income and its intersection with title loans, exploring the challenges and navigating their integration for those reliant on this income stream.

- Understanding Commission-Based Income: Definition and Basics

- Title Loans: Unlocking Access to Immediate Funds

- Navigating Challenges: Commission Income and Title Loans Integration

Understanding Commission-Based Income: Definition and Basics

Commission-based income is a payment structure where individuals are rewarded based on their performance or the volume of services rendered, rather than a fixed salary. In the context of a title loan for commission-based income individuals may receive a percentage of the loan value or successful referrals as their compensation. This model is prevalent in various industries, offering flexibility and potential high earnings but also presenting unique challenges.

For borrowers with commission-based incomes seeking Houston title loans, understanding these structures is crucial. Unlike traditional loans with fixed interest rates, commission-based income loans may have variable terms, affecting the overall cost. Moreover, strict credit checks are often a part of the process, which can be challenging for individuals with limited or less-than-perfect credit histories. Balancing the need for quick cash access and managing potential debt is essential for borrowers in this category.

Title Loans: Unlocking Access to Immediate Funds

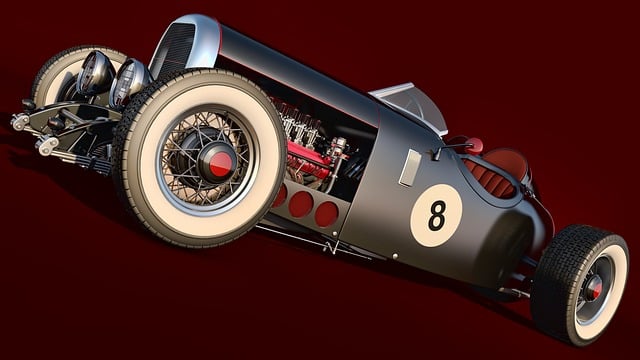

Commission-based income professionals often face unique financial challenges that can make accessing quick funds a necessity. This is where title loans step in as a viable solution, offering an alternative to traditional bank loans. By leveraging the value of their vehicles, individuals with commission-based income can unlock immediate cash through a title loan. This short-term financing option is particularly appealing for those who need fast access to capital, such as covering unexpected expenses or bridging financial gaps until their next pay check arrives.

Obtaining a title loan involves a straightforward process where lenders assess the vehicle’s valuation and determine the available loan amount. Unlike cash advances that focus on an individual’s income and credit history, title loans prioritize the asset—the vehicle itself—ensuring a secure lending environment for both parties. This approach allows commission-based income earners to gain approval for funds, enabling them to pay off urgent bills or make necessary repairs, thereby maintaining financial stability until their next commission cycle.

Navigating Challenges: Commission Income and Title Loans Integration

Integrating commission-based income with title loans can present unique challenges for lenders and borrowers alike. One of the primary obstacles is aligning the short-term nature of title loan products with the often variable and delayed compensation structures common in commission roles. Borrowers seeking a Dallas Title Loans solution need clear understanding of loan terms, as commission income’s unpredictability might strain their ability to meet repayment obligations.

Lenders must carefully structure loan terms and conditions to accommodate this variability while ensuring fair practices. Offering flexible loan payoff options, grace periods, or extended terms could help cater to the fluctuations in commission income, fostering a more sustainable borrowing experience for those reliant on such financial products.

Commission-based income in title loans presents unique challenges, but it also offers opportunities for both lenders and borrowers. By understanding the dynamics of commission-based models and their integration with title loans, industry professionals can better serve the needs of folks seeking fast access to funds. This innovative approach can revolutionize how we navigate financial hardships, providing a more flexible and tailored solution for those in need, especially among the self-employed or commission-only workers who rely on variable income streams.